Sbi ideco - SBI iDeCo funds portfolio. Anyone willing to help?

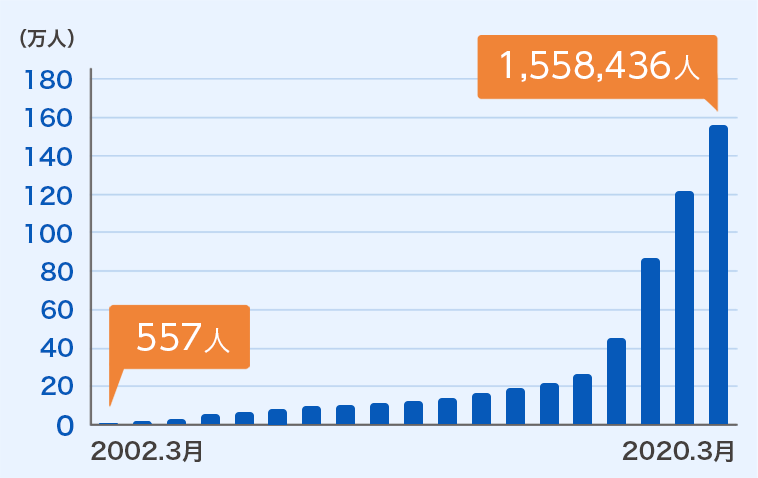

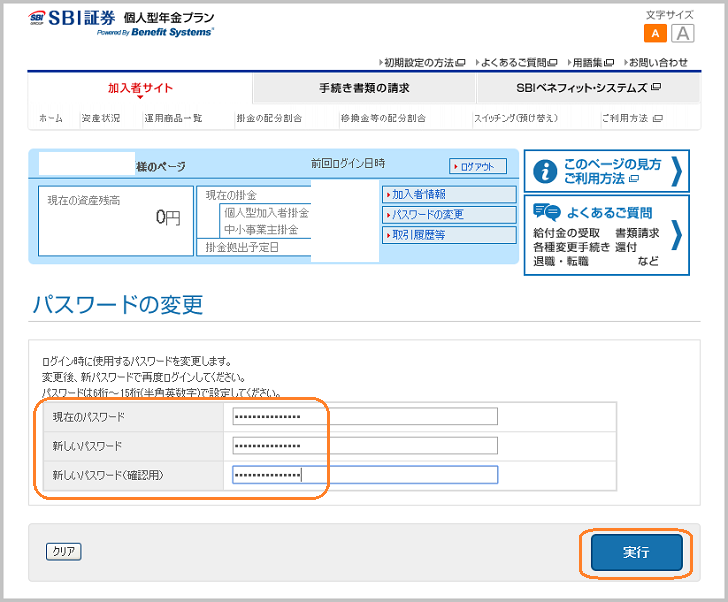

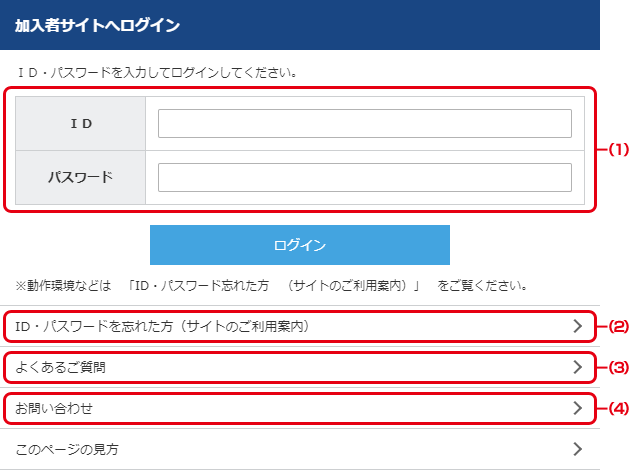

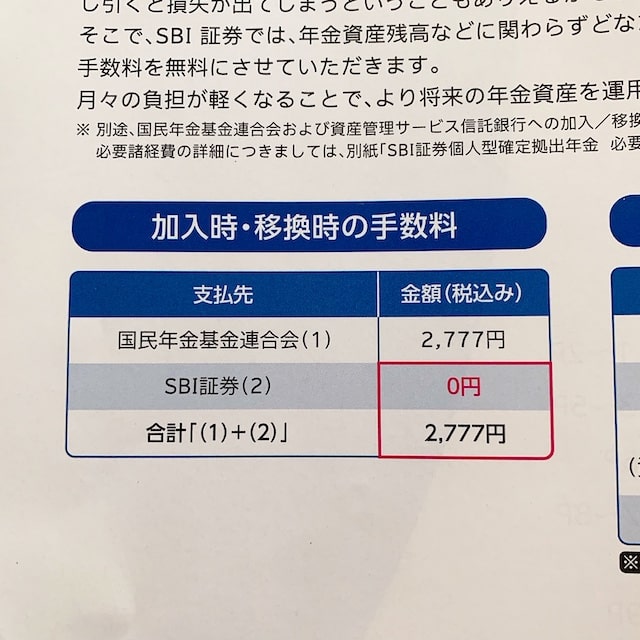

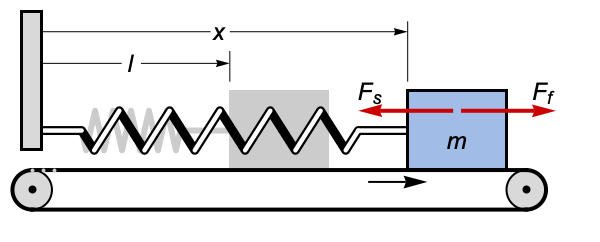

Currently, it is enhancing its presence not only in the online securities industry, but also in the securities industry as a whole by strongly promoting the expansion of its wholesale business through strengthening IPO and PO underwriting, business corporation and financial institution business, and overseas institutional investor business. I just wanted to share with you guys. Aggressive generally means 90-100% growth assets stocks, property etc. As one of Japan's leading venture capital firms, our management of venture capital funds is guided by our mission to become a leader in the creation and cultivation of key industries for the 21st century. It might be a weird portfolio, so I would like to balance it a little bit more, as it was my very first draft. Then in the end of the year, December I would have the next situation: 5K x 6 yens spent on Fund-A - 138. For the investment decision process, an advisory board consisting of specialists in several fields such as fund investors is established. Our investment structure makes effective use of management resources within the SBI Group. I did not want to put everything into stocks, so I thought that bonds could also be a part of my portfolio. And as also Jamo is saying in the other response thanks Jamo! Putting my words into an example, let's assume that I just contribute every month with 23K and my portfolio is: Code: - From January to June, 6 months: - 69. You choose which investments to sell, and which to buy. Company name SBI SECURITIES Co. Now I just changed from 4 funds to just 2 funds, and the portfolio stills close to the 70% growth assets that Jamo was mentioning on his response. The SBI EXE-i funds have higher fees of about 0. It was awarded the top position in the fund of the year contest that you mentioned. I am thinking about pulling it in and remove one of the four I took. I thought it was a good balance and it also got the 4th position in the Fund of the Year 2016. I would just go with the one with the cheapest fee Good morning Dan, Thank you for your reply. SBI Investment is the core company in the SBI Group's Asset Management Business. Do you think that this it also a very aggressive portfolio? As a result, SBI SECURITIES have gained great support from individual investors, establishing its position as the industry top in terms of the number of accounts, assets under deposit, and individual stock brokerage fees. Fri Nov 17, 2017 1:02 am One more question, if I might ask. However, if you die your heirs get the balance of the account RetireJapan has already answered your question about restrictions on taking money out. Most of these funds offer exposure to foreign markets through Vanguard and Schwab ETFs. Well, actually last year was the very first year for this fund. So I wanted to have like a 70% on this balance funds, and then the rest of the 30% on another stock funds, but as you were mentioning even the balance funds have some positions in stocks both Japan and US. Also, don't be swayed by past fund performance. I saw that you can change your funds to buy once per year, but, are we allowed to sell funds also or we just need to keep up all the fund participations that we bought until we retire 60 years old? Fri Nov 17, 2017 1:56 am I just realised you may have been asking about rebalancing the account called 'switching' by providers. Your selection appears to contain around 60% of stocks, and around 8% property. I would have a look at the products the funds hold and their fees and decide from there. I know I cannot retire any money that I put into the iDeCo until I have 60 years old, but I did want to know if selling a fund participations to have cash to buy another fund participations was allowed. Nissay's foreign equity DC fund offers exactly the same strategy as that fund because they feed into the same mother fund. Hi, this is my first comment here, I applied for an SBI account and I got a lot of links and information about the funds line-up for iDeCo, which is impressively long and they are providing the information for each and every one of them, along with the past month rentabilities. Our efforts have generated a succession of IPOs and we have thus contributed to the well-being of society. I might not need 4 funds but less if all the assets that I want to invest are already covered there. In addition to management skill and talent, we carefully consider market growth potential, uniqueness, differentiation from competitors, and feasibility of business model. At least if you are using SBI as your brokerage then you could find it familiar. But everyone has their own risk tolerance, and your current weightings will still serve you well. All in all, I have not sent yet the letter with all my choices to SBI. One more question, if I might ask. Sorry about me doing that many questions, but as you can see I am kind of a newbie. After your answer I had a look at the SBI EXE-i funds for developed markets equity fund and it looks nice. With this solid infrastructure in place, we can help venture companies overcome insufficient management resources. If I was your age I'm currently 34 , I would still be quite comfortable with an aggressive portfolio made up of mostly index funds. I have so many things to learn about fund investments. By utilizing external resources, our decisions on investments are more diversified and comprehensive. It has seen more inflows than many other Japanese foreign equity index funds. I hope I did explain myself this time Sorry again for so many questions about it, but hopefully this example can be also interesting for another newbies to the iDeCo in the future. Hi Dan and RetireJapan, and thanks for your answers, Actually I did know about that I cannot get the money until I reach 60, maybe I formulated the question in the wrong way English is not my native language. For example, the SBI EXE-i developed markets equity fund invests about 60% of assets in the Schwab US Broad Market ETF, 30% in the Vanguard FTSE Europe ETF and 10% in the Vanguard FTSE Developed Asia Pacific ex-Japan UCITS ETF. Thank you very much in advance again for all your help! It can be also easier to follow up. SBI SECURITIES will endeavor towards proactive expansion of promotion and services for NISA small amount investment tax exemption system and iDeCo individual defined contribution pension plan , as well as provision of highly convenient financial services through cooperation with companies in and outside of the SBI Group including companies in other industries. Do you have any recommendation about it? The minimum investment amount is set at ¥5,000 a month. You can do this in your account. As a result, our activities help the growth of our investees and enhance these corporate values. When I'm around 50 I will consider scaling back to a more balanced portfolio given that it generally takes around 10 years to recover from a crash. Since establishment, SBI Investment has focused on investments on growth sectors such as information technology, biotechnology and life science. Any opinion about it will be highly appreciate it. I have to say that it's an overwhelming piece of information 76 pages of report! It seems you have put together a portfolio largely focusing on foreign markets. So it can be described as a "growth" portfolio around 70% growth assets. Or even sell that fund participations because is performing bad and you want to have cash for another opportunity in another fund or to make a more conservative investment. Besides domestic stocks, the product lineup extends to investment trusts, foreign stocks, futures and options, FX foreign exchange margin trading , domestic and foreign bonds, etc. Your portfolio is definitely not aggressive. That's good and also a relieve! Either switching or rebalancing is allowed. Company name SBI Investment Co. The exact exposure is shown in the monthly reports of the funds. Actually I just wrote a message explaining myself with a practical example, but now I know the word for that. With the mission statement of the SBI Group as our guidance, we will continue to support the growth aspirations of venture companies and contribute to the advancement of society. Just working in the funds draft. And for the last 15%, again US stocks. I just realised you may have been asking about rebalancing the account called 'switching' by providers. Thank you again for your help. I just did it for my daughter -her account was set to automatically invest in cash deposits, so I switched that money to another fund. You can leave your investments in the account until you reach 70 if you choose and they remain tax-free. The fees on the Nikko DC funds are low. I was trying to get through some of this information and I came up with my first pre-portfolio. Principal business Comprehensive online securities business Representative Yoshitaka Kitao, Masato Takamura Location Izumi Garden Tower, 1-6-1 Roppongi, Minato-ku, Tokyo Date of establishment April 26, 1999 Date of change in corporate name Paid-in capital 48. And there's no need to overdo it with multiple fund selections if the funds hold similar products. Our investment criteria take many factors into consideration.。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

。

- 関連記事

2021 lentcardenas.com